em... v tistem členu piše:

Customs matters

Article 20

Customs control. Customs duty and other fees

1 The designated operators of the countries of origin and destination

shall be authorized to submit items to customs control, according to the

legislation of those countries.

2 Items submitted to customs control may be subjected to a presenta-

tion-to-Customs charge, the guideline amount of which is set in the Regula-

tions. This charge shall only be collected for the submission to Customs and

customs clearance of items which have attracted customs charges or any

other similar charge.

3 Designated operators which are authorized to clear items through the

Customs on behalf of customers, whether in the name of the customer or of

the designated operator of the destination country, may charge customers a

customs clearance fee based on the actual costs. This fee may be charged

for all items declared at Customs according to national legislation, including

those exempt from customs duty. Customers shall be clearly informed in

advance about the required fee.

4 Designated operators shall be authorized to collect from the senders

or addressees of items, as the case may be, the customs duty and all other

fees which may be due.

(stran 18):

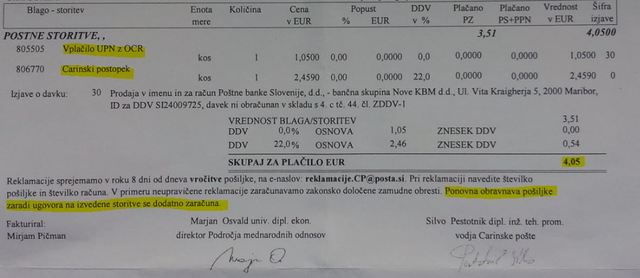

20.2

Presentation to Customs charge collected by the designated operator of destination may only be collected when customs charges or any other similar charges are payable on the parcel.

20.3

Customs clearance fee - Fee based on the actual costs of the operation

http://www.upu.int/uploads/tx_sbdownloader/actInFourVolumesParcelPostManualEn.pdf